This T4 guide provides details on your T4 – Statement of Remuneration Paid.

If you would like clarification on any of the information provided or more help in preparing your tax return, please contact the Canada Revenue Agency (CRA) at 1-800-959-8281.

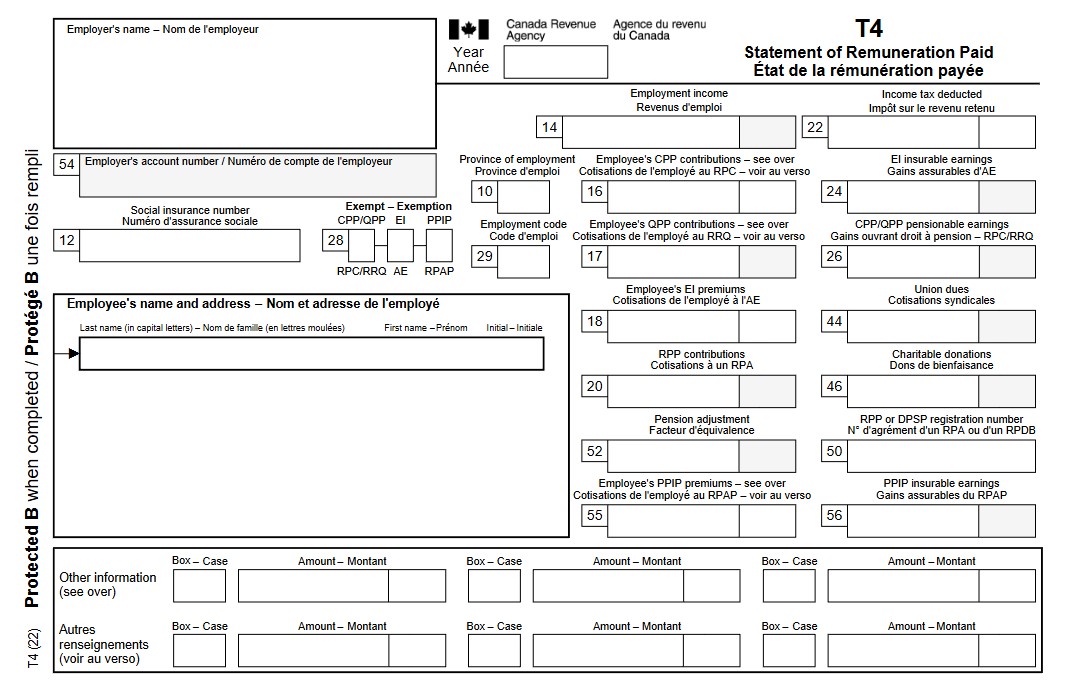

Sample T4

Reports Alberta (AB) as the Province of Employment.

Reports your Social Insurance Number. Ensure your Social Insurance Number is correct.

The amount reported in Box 14 is the sum of all taxable income, allowances and benefits paid or provided to you for the taxation year.

Please note that it is more than just your year-to-date (YTD) gross wages. Box 14 also includes taxable benefits that are reported in other boxes on your T4.

Reports the amount of Canada Pension Plan (CPP) contributions deducted from your remuneration for the taxation year.

Reports the amount of Employment Insurance (EI) premiums deducted from your remuneration for the taxation year.

Reports the Registered Pension Plan Contributions for pensionable service for the previous year, as well as prior pensionable service.

Reports the amount of Income Tax (Federal and Provincial) deducted from your remuneration for the taxation year.

Reports the EI Insurable Earnings for the taxation year.

Reports the amount of Canada Pension Plan Pensionable Earnings for the taxation year.

Marked with an “X” if you are exempt from Canada Pension Plan contributions or Employment Insurance premiums. This does not apply to most employees.

Reports the amount of Union Dues paid.

Reports the amount deducted for Charitable Donations that are eligible to be claimed as a donation to a registered charitable organization. Deductions under code CHAR% are reported as charitable donations at 75% of your annual deduction, and the remaining 25% applies to the Employee Bursary Fund in your union, which is not tax-deductible, therefore, not reported in Box 46.

United Way charitable payroll deductions under code UW and EPL charitable deductions under code ECD are also reported in Box 46 at 100% of contributions made.

Reports the Pension Plan Registration Number for the pension plan in which you participate.

Records your Pension Adjustment. This represents the value of your pension for the taxation year as deemed by the Canada Revenue Agency.

Other Information Section

Reports the amount of second CPP deducted from the additional pensionable earnings.

City provided vehicles, taxable benefits associated with the personal use of the employer's motor vehicle.

Reports the dollar value of employer-paid taxable benefits and are included in Box 14. The most commonly reported taxable benefits while working for the City of Edmonton are:

- City paid premiums, for group term life insurance

- Reduced rate bus passes, the difference between the regular cost of the pass and the reduced rate offered to employees is considered a taxable benefit by Canada Revenue Agency

- City paid parking, deemed a taxable benefit by Canada Revenue Agency

Reports the total monthly tax exemption amount while an employee was deployed in International Peacekeeping Operations for the taxation year. This amount is included in Box 14.

For the 2023 calendar year and onwards, it is mandatory to indicate whether the employee or any of their family members were eligible, on December 31 of that year, to access any dental care insurance or coverage of dental services of any kind, as follows:

- Code 1 - No access to any dental care insurance or coverage of dental services of any kind

- Code 2 - Access to any dental care insurance or coverage of dental services of any kind for only the payee

- Code 3 - Access to any dental care insurance or coverage of dental services of any kind for payee, spouse and dependents

- Code 4 - Access to any dental care insurance or coverage of dental services of any kind for only the payee and their spouse

- Code 5 - Access to any dental care insurance or coverage of dental services of any kind for only the payee and dependents

Reports any Eligible Retiring Allowances, including income plan replacement payments, for the taxation year (note that taxes deducted from these amounts are included in Box 22 Income Tax). These payments are not included in Box 14.

Reports any Non-Eligible Retiring Allowances for the taxation year (note that taxes deducted from these amounts are included in Box 22 Income Tax). These payments are not included in Box 14.

Workers’ Compensation Payments received by the City from Workers’ Compensation on your behalf in the taxation year for earnings losses. (note this box is completed for Edmonton Police Services employees only unless claims adjudicated are from a previous taxation year).

Employee-paid benefit premiums for the taxation year. An employee may be able to claim their premiums paid for private health services plans as qualifying medical expenses (refer to CRA website for further information).