Understanding and reviewing your pay advice regularly is important. Has your address or personal tax situation changed? Have you experienced a life event that may impact your benefit premium deductions? Have you signed up for a voluntary deduction, such as United Way?

Access your pay advice online from anywhere using the following 4 steps:

- Visit Workspace One

- Log in to your account (3+3 or S100 number)

- Select the Pay Advice tile to view your recent pay advice

- View your current pay advice or a previous pay advice using the menu

Visit Benefits at a Glance for more information about your benefit coverage and the premium deduction rates.

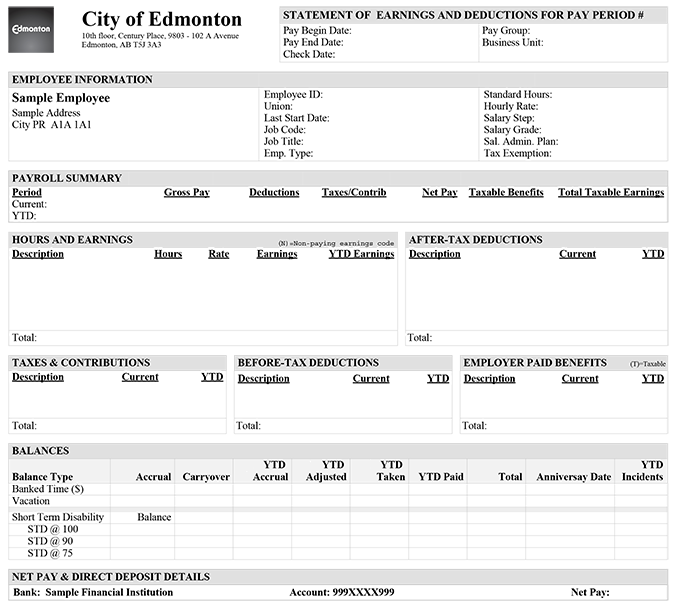

Sample Pay Advice

Pay Begin Date

First day of the applicable pay period

Pay End Date

Last day of the applicable pay period

Check Date

Pay deposit date for the applicable pay period

Pay Group

City of Edmonton

Business Unit

City of Edmonton

Name/Address

Your name and mailing address currently on file. To change your mailing address, please submit a completed Personal Information Changes form found on onecity/Payroll to the Employee Service Centre.

Employee ID

Your unique 7-digit payroll number

Union

The Union or Association under which jurisdiction your position falls

Last Start Date

Your most recent hire or re-hire date with the City of Edmonton

Job Code

The number that is used to identify the class of your position. The word "class" refers to a group of positions having sufficiently similar duties, responsibilities, authority and required qualifications that a common descriptive title is used

Job Title

The title that is used to identify the class of your position. The word "class" refers to a group of positions having sufficiently similar duties, responsibilities, authority and required qualifications that a common descriptive title may be used

Emp. Title

Your employment status as either Permanent or Temporary, Full-Time or Part-Time

Standard Hours

The number of normal working hours you were hired to perform on a weekly basis. Full-time employees normally work the Standard Hours for their Job Code while part-time employees work fewer hours based on operational requirements

Hourly Rate

The hourly rate corresponding to your Sal. Admin. Plan, Salary Grade and Salary Step which is used to calculate your Gross Pay for the applicable pay period

Salary Step

The Step in the Salary Grade that you are compensated at, following your Collective Agreement if you are a unionized employee. If you are a management employee, the Salary Step will be blank as Management Salary Grades are based on a range of salaries with a minimum and maximum value

Salary Grade

The Salary Grade that is associated with your Job Code, following the applicable Collective Agreements for unionized employees and the Annual Management Salary Schedule for management employees

Sal. Admin Plan

The Salary Administration Plan that is associated with the Job Code, following the applicable Collective Agreement for unionized employees and the Annual Management Salary Schedule for management employees

Tax Exemption

Your personal federal tax credit amount used to calculate your Total Taxable Earnings. Personal tax credits are defined by Canada Revenue Agency (CRA). If you are interested in claiming more or less credits, please submit a completed TD-1 and TD-1AB form that can be found on onecity/Payroll or on CRA's website to the Employee Service Centre

Period - Current

Your amounts relating to the applicable pay period

Period - YTD

Your year-to-date (YTD) amounts for the current payroll year to the end of the applicable pay period

Gross Pay

Your total earnings before taxes or deductions

Deductions

Your total amount of Before-Tax and After-Tax Deductions deducted from your pay

Taxes/Contrib

Your total amount of legislatively required Taxes and Contributions deducted from your Gross Pay

Net Pay

The remainder of your Gross Pay less Deductions and Taxes/Contrib

Taxable Benefits

The value of all benefits that are defined as taxable (such as employer paid benefits) as legislated by Canada Revenue Agency. This value is included in the your taxable income on which tax deductions are calculated. Common examples of taxable benefits include:

GRP Life* - Employer Paid Group Life Insurance

Tx Em Car - Taxable Employer Car

Txble Park - Taxable Parking

Tax Bus Ps - Taxable Bus Pass

Total Taxable Benefits

Your Taxable Earnings calculated as Gross Pay plus Taxable Benefits

Description

The name of the Earning that you are being compensated for. Detailed descriptions of each of the Earnings codes can be found on onecity/Payroll

Hours

The total number of hours for the corresponding earnings description for the applicable pay period

Rate

The hourly rate at which you are paid, including rated up or acting duties

Earnings

Your earnings for the corresponding Earnings description for the applicable pay period calculated as Hours multiplied by Rate

YTD Earnings

Your total earnings for the corresponding Earning description to date for the applicable payroll year

Description

The name of the After-Tax Deduction that you are being deducted for. After-Tax Deductions do not reduce your Total Taxable Earnings and are deducted from your Gross Pay less Taxes/Contrib. Common examples of After-Tax Deductions include:

Char % - Charitable Donations

CSB - Canada Savings Bonds

Ltd - Long Term Disability

Major Med - Major Medical

Current

Your After-Tax Deductions amount for the corresponding description for the applicable pay period

YTD

Your total After-Tax Deductions amount for the corresponding description for the applicable payroll year

Description

The name of the Tax or Contribution (Income Tax, Canada Pension Plan (CPP), Employment Insurance (EI)) that is being deducted from your pay

Current

Your Taxes and Contributions amounts for the corresponding description for the applicable pay period

YTD

Your total Taxes and Contributions amounts for the corresponding description for the applicable payroll year

Description

The name of the Before-Tax Deduction that is being deducted from your pay. Before-Tax Deductions reduce your Total Taxable Earnings and therefore reduce the amount of Tax you pay. Common examples of Before-Tax Deductions include:

Lap Pensn - LAPP Pension

Un Dues FR - Union Dues Flat Rate

U Dues % - Union Dues %

Current

Your Before-Tax Deductions amount for the corresponding description for the applicable pay period

YTD

Your total Before-Tax Deductions amount for the corresponding description for the applicable payroll year

Description

The name of your Employer Paid Benefit to the specific benefit listed. Common examples of Employer Paid Benefits include:

Lap Pensn - LAPP Pension

Dental - Dental

Major Med - Major Medical

Grp Life (T) - Group Life Insurance

Current

The Employer Paid Benefits amount for the corresponding description for the applicable pay period

YTD

The total Employer Paid Benefits amount for the corresponding description for the applicable payroll year

Balance Type

The specific leave plan for which balances are maintained (Banked Time, Vacation, Annual Funded Leave and Short Term Disability)

Accrual

The number of Vacation hours you earn each pay period based on your years of City employment

Carryover

The number of hours that were brought forward from your previous year's entitlement on your Anniversary Date

YTD Accrual

The number of hours you have earned from your Anniversary Date to the end of the applicable pay period

YTD Adjusted

The number of hours that have been credited or debited to correct your leave balance from your Anniversary Date to the end of the applicable pay period

YTD Taken

The number of hours you have taken from your Anniversary Date to the end of the applicable pay period

YTD Paid

The number of hours you were paid out as cash from your Anniversary Date to the end of the applicable pay period. Requests for Vacation payouts must be approved by your Department's General Manager. Requests for Banked Time payouts are processed based on your written request

Total

The number of hours of entitlement at the end of the pay period (Carryover plus YTD Accrual plus YTD Adjusted less YTD Taken less YTD Paid equals Total)

Anniversary Date

Your Anniversary Date for Vacation Leave is based on your most recent hire or re-hire with the City. For example, if you were hired on January 15 2015, your Anniversary Date is January 15 2015. Your new Vacation Year will start on January 15 each year

Your Anniversary Date for Banked Time is based on the Union or Association your position is associated with as follows:

- CSU 52, IBEW 1007 and Out-of-Scope - Last day of the last full Pay Period in April each year

- CUPE 30 - Last day of the Pay Period in which May 1 falls each year

- EFFU 209 and Management - Last day of the previous Payroll Year

YTD Incidents

The number of your Short-Term Disability incidents in the applicable payroll year. Each period of absence from work due to non-occupational disability which exceeds three (3) hours is counted as one incident of absence

Balance

The number of your Short-Term Disability hours for the applicable payroll year

Bank

The name of the financial institution to which your pay is being deposited

Account

The account number (partially encrypted to ensure protection of your identity) to which your pay is being deposited

Net Pay

The amount of pay that is deposited to your account on the applicable Check Date. Refer to the description of "Net Pay" provided in the PAYROLL SUMMARY section above for further information