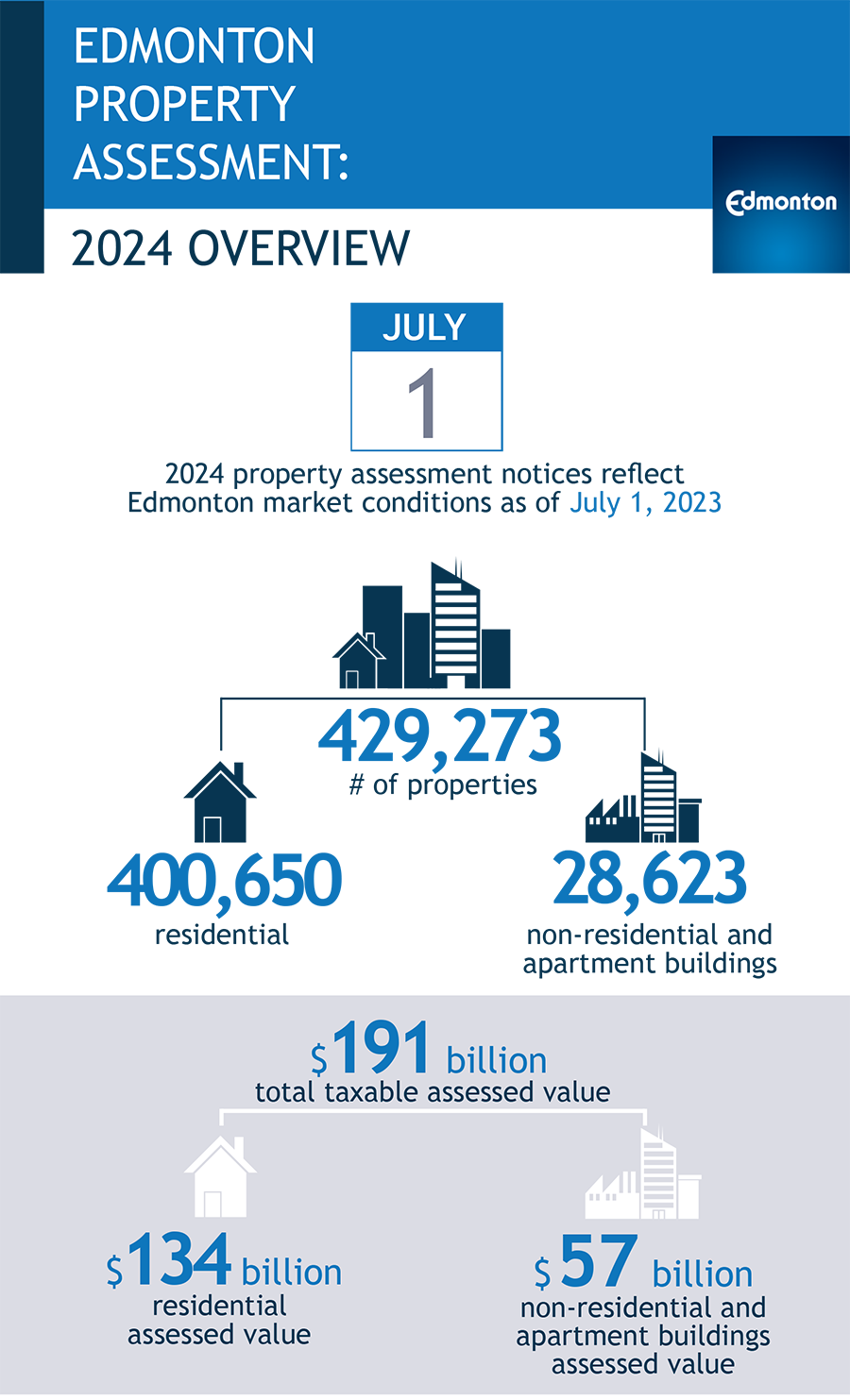

The City distributes property assessment notices in early January to all property owners within Edmonton to give you an opportunity to review your property’s assessed value, obtain more information if you have questions about your updated market value assessment and plan ahead for your property tax payment.

Please choose between the following three options:

Skip to main menu Skip to site search Continue to current page menu and content